Continue Reading

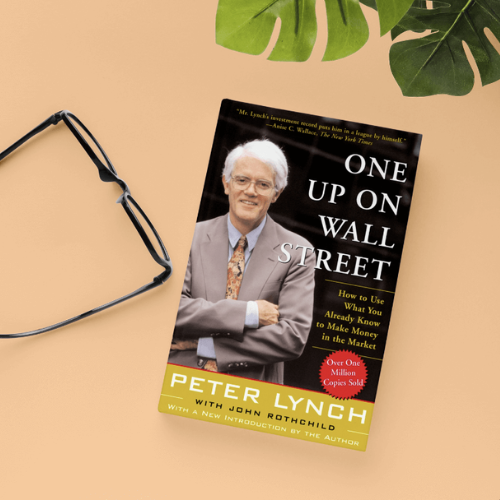

3 of Our Favorite Engaging (and Not Stuffy) Financial-Related Books & Why

Yes, we believe everyone should have a financial advisor they can turn to as a guide and sounding board. But we also believe that when it comes to your finances, soaking up knowledge and insights from a range of perspectives is vital! Check out three engaging and enlightening financial-related books touching on topics like financial independence, investing, and economics.

Continue Reading

3 Essential ETF Investment Considerations

Over the past 20 years, we’ve seen the proliferation of exchange-traded funds (ETFs) and their disruptive forces across global financial markets. As of the end 2022, global ETF assets under management (AUM) reached $9.6 trillion, up from $204 billion in 2003. (Statista) ETF AUM has grown at about a 15% CAGR here in the U.S. since 2010. (OliverWyman)

Continue Reading

Carlson Quarterly – Q2 2024

In the second quarter of 2024, the U.S. market demonstrated notable resilience and strength as the S&P 500 experienced substantial gains, driven primarily by the technology and communications sectors, with Mega-cap stocks leading the charge as companies race to be the dominant AI provider.

Continue Reading

A Strong Dollar Means Summer Vacation Deals

If you’ve followed the market, you’ve watched the U.S. Dollar (USD) gain strength for the last several months. Let’s examine the impact of the strong dollar and what it could mean for your summer travels.

Continue Reading

401(k) Rollovers: Not Just for Retirees

401(k)s can streamline retirement savings by taking advantage of the automated payroll deduction and employer match. However, as you get closer to retirement, a 401(k) may not be the most beneficial type of account. That’s why reviewing your options early based on your financial and retirement goals is a good idea.

Continue Reading

Mid-Year Tax Planning: Why Review Your Taxes & Finances in June?

Very few people enjoy the “puzzle” that is taxes. While the tax code may be a puzzle, it can be profitable if you understand the rules and maximize your tax savings. Plus, the more you plan, the more you can avoid the stress of tax preparation after the year is over.

Let's talk.

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.