This Website is intended for Institutional Use Only

For purposes of this Website, the term “Institutional” includes but is not limited to sophisticated non-retail investors such as investment companies, banks, insurance companies, investment advisers, plan sponsors, endowments, government entities, high net worth natural persons and people acting solely on behalf of Institutional Investors. Certain products and investment services may only be available to qualified Institutional Investors as defined in Rule 205-3(d)(1) under the Investment Advisers Act of 1940, as amended.

This information is not intended to be published or made available to any person in any jurisdiction where doing so would result in contravention of any applicable laws or regulations. The user should ensure that the use of this information does not contravene any such restrictions.

Information contained within the Website does not constitute an offer to buy or solicitation to sell a security, or any other product or service, to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction.

The views and information contained within this website are provided for informational purposes only and are not meant as investment advice. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any Carlson investment product or service. Neither Carlson, nor its representatives, are legal or tax advisors. The investments you choose should correspond to your financial needs, goals, and risk tolerance.

Do you agree with the terms and conditions above?

Our philosophy

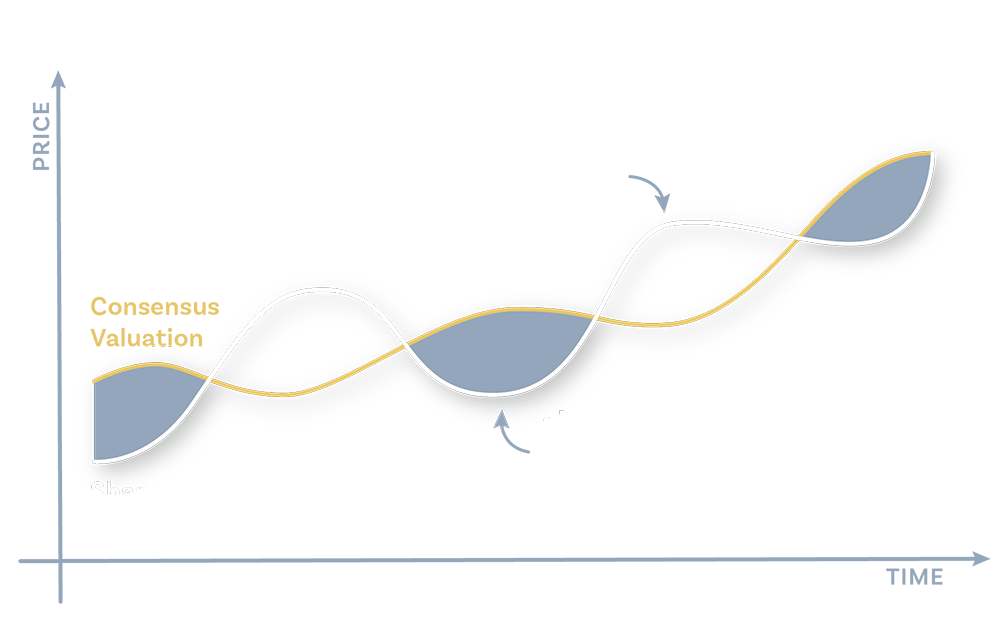

Market inefficiencies driven by fear and greed create attractive opportunities for the disciplined investor. Our proprietary research process and active risk management has proven itself through many market cycles and transitions.

philosophy

Research Process: Identifying “Best Ideas”

1

Top-Down Thematic Insight

- Sourcing ideas from an experienced investment team

- Identify themes and stocks that are out of favor and/or the headlines

Industry Factors:

- Macro environment

- Consolidation

- Demand growth

- Capacity constraints

- New Regulation

Visualizing impact of fundamental change(s); revisiting what could go wrong.

2

Bottom-Up Thesis Analysis

- Sustainable competitive advantages

- Solid balance sheets (quality); rising earnings; growing market share

- Attractive returns on capital

- Free cash-flow generation

- Growing Revenue, EPS

- Industry-specific factors

- Investment thesis differs from consensus

3

Portfolio Construction

Key Themes:

- Silicon Carbide

- Semiconductors

- Digital Platforms

- Energy

50—70 holdings actively managed

Thematic ideas, security selection, and risk management to drive long-term success.

4

Risk Management

- Mandate compliance

- Actively managed position sizing

- Automatic review of stock thesis with a 15% price decline from cost

- Sell discipline

Translating Research Insights into Alpha

1

Research Prioritization

250 stocks

- Benchmark constituents

- Thematic priorities

- Ongoing monitoring of focus list

- Earnings growth

- Valuation opportunity

- Catalyst recognition

- Growth sustainability

- Earnings surprise

- Industry cycle

- Product cycle

2

Fundamental Research

“Watch List” 100—120 stocks

Independent research conclusions company evaluation:

- Fundamentals/catalysts

- Financial strength

- Management/competitors

Brand/intellectual property proprietary sector-specific analysis:

- 2-year time horizon

- Ample margin for error

- Identify risk factor

3

Portfolio Construction

50—70 stocks

Differentiated insights

Active sector weight positions

Broad sector diversification

Trimming and adding to current positions as equally important to strategy as introducing or eliminating holdings

Risk management:

- Specific rules to manage downside risk (e.g. position and sector limits)

- Margin of safety

- Sell discipline

Let’s talk.

Our leadership team is eager to understand the unique challenges you and the people you serve face to get to work developing a strategy to create lasting impact.

Let’s get started.

Contact

"*" indicates required fields