A new year brings new contribution limits for your retirement accounts. These limits dictate the maximum amount of money that can be deposited into an account for the year—and as we always say, it’s best to start planning as early as possible!

Retirement accounts are tax-advantaged accounts that are either sponsored through an employer or individually funded. These include 401(k)s, 403(b)s, Traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plans for Employees (SIMPLE) IRAs. The IRS imposes limits on these plans annually that dictate how much can be contributed for that calendar year.

While there are a few notable increases in the 2025 contribution limits on employer-sponsored accounts, the IRA limits remain largely the same as in 2024. Only SEP IRAs and SIMPLE IRAs saw increases.

So, how will the latest contribution limits impact your retirement savings for the year ahead? Let’s break down the numbers to get you started.

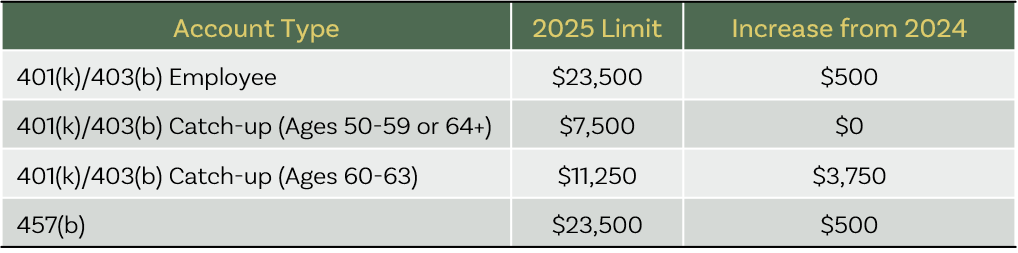

Employer-Sponsored Retirement Account Contribution Limits

Employer-sponsored accounts are offered through your workplace and often include an employer match contribution. You decide what percentage of your pay you want to contribute each period, and your employer deducts that from your paycheck.

Employees over 50 can make a catch-up contribution, allowing them to contribute an extra $7,500 to their 401(k). 2025 is the first year a “super catch-up” is offered for employees between 60 and 63, bringing the total limit to $34,750 for those individuals.

Below are the 2025 contribution limits and increases from 2024. These apply to both Traditional (pre-tax) and Roth (post-tax) plans.

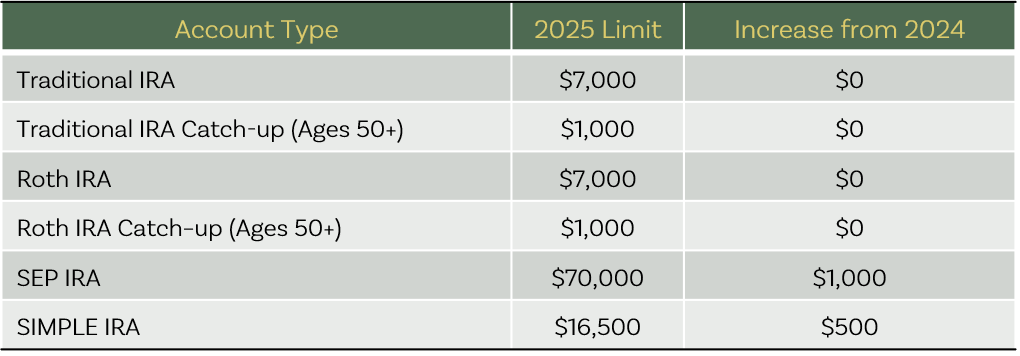

IRA Contribution Limits

Individual retirement accounts (IRAs) are often used by individuals who cannot contribute to employer-sponsored plans but still want to use a tax-advantaged account.

Traditional IRAs differ from Roth IRAs regarding when the money contributed is taxed. Traditional IRA contributions are typically tax-deferred until you withdraw the funds in retirement. Roth IRA contributions are made post-tax, meaning you pay the taxes today so the funds grow tax-free and you won’t have to pay taxes on withdrawals in retirement. Head to our article on Traditional vs. Roth IRAs to learn more about the benefits of each.

There are also SEP and SIMPLE IRAs, which self-employed individuals and small businesses often use to offer retirement plans for themselves and their employees.

Regarding SEP IRA contributions:

- Only the employer can make contributions.

- These contributions must be equal for all eligible employees.

- There are no catch-up contributions.

When it comes to SIMPLE IRAs:

- Employers must set up accounts for all eligible employees (i.e., those who earned at least $5,000 in any two previous calendar years and are expected to earn at least $5,000 in compensation during the calendar year).

- Employees may choose to contribute or not.

- Employers must make either a matching contribution of up to 3% of the employee’s compensation or a 2% non-elective contribution.

The following are the 2025 IRA contribution limits.

Find more information about retirement contribution limits from the IRS website.

Contribution limits are important to note, as any contribution that exceeds this limit can incur extra taxes if not withdrawn in a timely manner. Whether you have questions about your retirement account contributions or you’re ready to set up a new plan, reach out to a Carlson Investments advisor today!

Carlson Investments does not provide tax, legal, or accounting advice. This content has been written for informational purposes only. Always consult your individual tax, legal, or financial professionals for advice tailored to your situation.

Let's Talk

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.

Contact Us