Total return is an important metric of equity performance that investors often overlook. The total return of an equity investment is a combination of its capital appreciation or depreciation and the dividend received. Investors often focus on the former component yet the latter has contributed a meaningful percentage of the overall return of the stock market throughout history. In fact, dividends contributed 44% of the total return of the Standard and Poors 500 index from 1926 through the end of 2009.1 This contribution has been more pronounced during periods of weak market returns. For example, during the 1970s and 2000s, dividends contributed 77% and 62% respectively to overall returns. 2

An equally important metric to consider is dividend growth. Many high quality companies have increased their dividends for consecutive years and often at rates well above inflation. There are several advantages to identifying and owning these companies in a diversified portfolio. They are:

- Owning companies that increase their dividends each year provides an investor with a steady and rising income. This is an especially attractive benefit for those in retirement and who may be relying on their portfolios to supplement their income needs.

- Dividend growers have historically outperformed non-dividend payers over long periods of time and with less volatility.

- This outperformance is more dramatic during periods of weak market returns. Intuitively, this makes sense when you consider that dividend growers are often companies with healthy balance sheets, strong cash flows, and a management emphasis on shareholder returns.

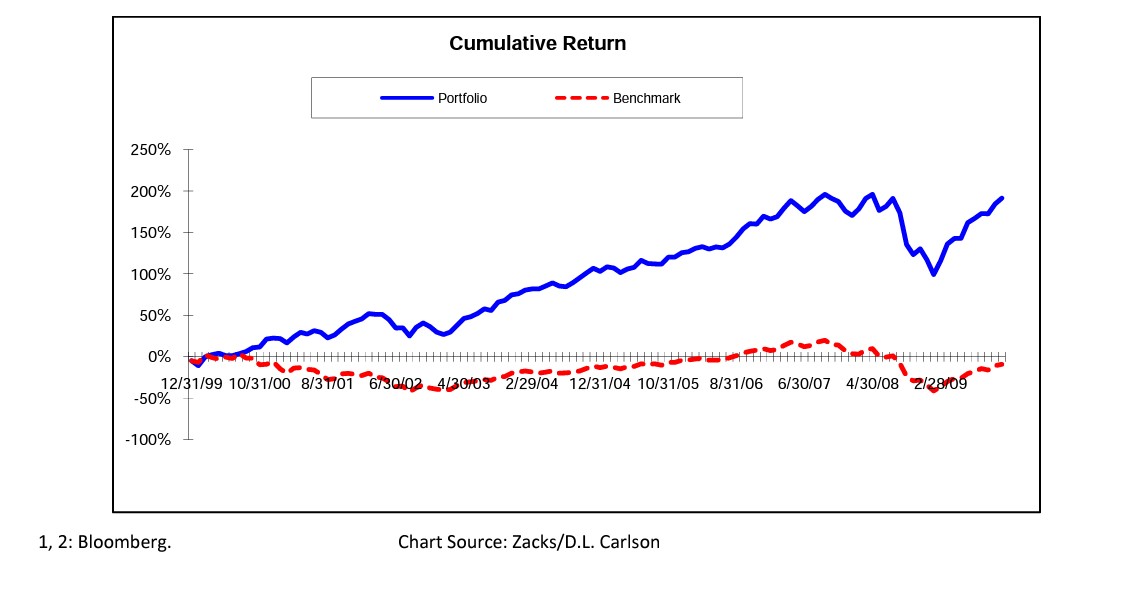

The chart below illustrates the outperformance of the subset of 47 dividend growers within the S&P 500 versus the S&P 500 in aggregate over the 10 years ending 2009.

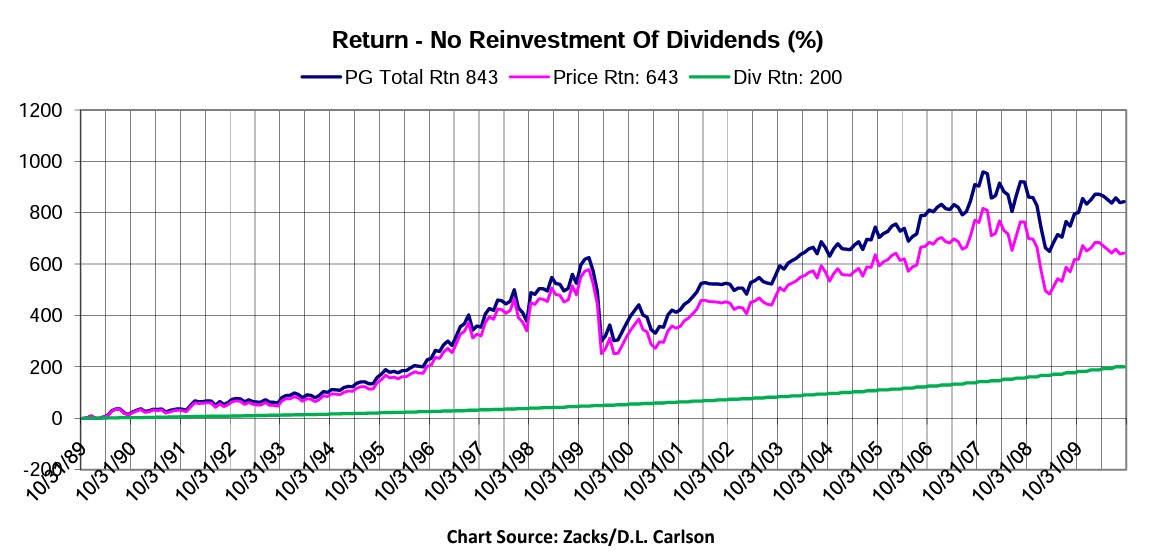

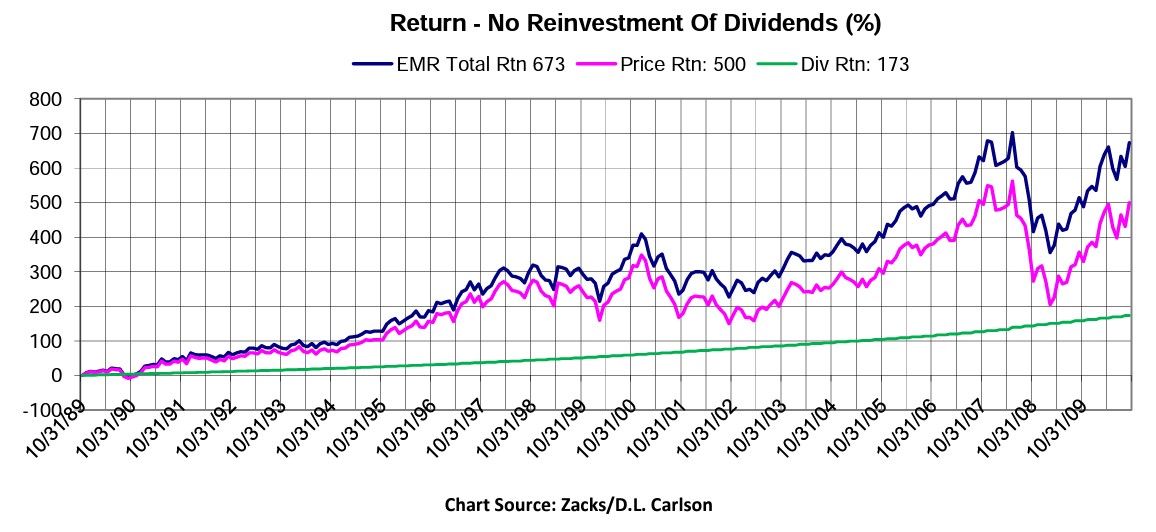

To further illustrate the importance of dividend growth and how it impacts total return, we can observe the historical break down of the total return of Procter and Gamble and Emerson Electric in the graphs below. Both companies have increased their dividends each year for the past twenty years. Notice that although the price component of the return has experienced volatility, especially during the 2000-2002 and 2007-2009 markets, the income component has experienced a smooth, uninterrupted positive path. As discussed before, owning dividend growth stocks helps to lower the overall volatility of returns while providing a rising stream of cash flow. The receipt of dividends is a tangible benefit to the investor that has been consistent regardless of market gyrations or economic cycles

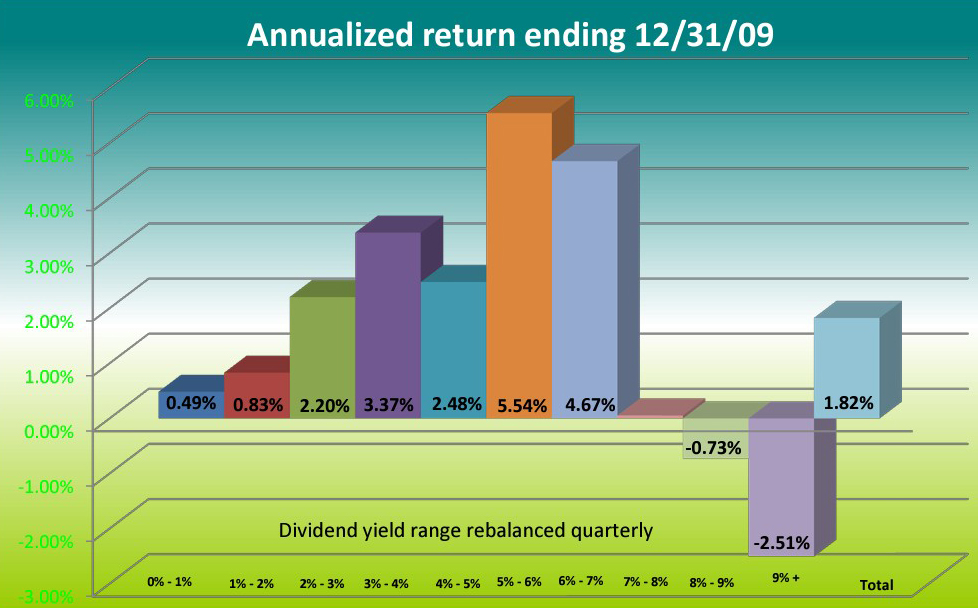

The current low interest rate and slow economic environment has made dividend paying investment strategies very attractive. As the spotlight has been cast upon dividend yields, investors should be cautioned not to “chase” yield. A strategy that invested in companies with the highest absolute yields resulted in poor results. Such companies may have unusually high yields because of depressed stock prices or dangerously high payout ratios. The margin for error is low for companies in weak financial condition. A more rewarding strategy has been to invest in the middle to upper quintiles of absolute yield as the majority of dividend growers reside in these categories.

S&P 500 dividend paying companies average annual return for ten years ending 12/31/09.

CONCLUSION

- Dividends have historically made a significant contribution to investment performance.

- Dividends growers provide investors with a rising stream of cash flow.

- Dividend growers perform better during weak economic periods.

- Dividend yield alone does not determine the quality of a company.

- Companies should be selected using in depth cash flow analysis by experienced professionals.

HOW WE CAN HELP

At D.L. Carlson, many of the equities in the core portion of our portfolios are high quality companies that have consistently increased their dividends for many years. We combine these core holdings with opportunity stocks-smaller companies with either niche technologies or value propositions which allows our clients to participate in a wide range of opportunities.

Let's Talk

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.

Contact Us