The average person’s debt takes many forms. It can include credit cards, auto loans, mortgages, school loans, and personal loans. According to Business Insider, the average debt in America was $104,215 across mortgages, auto loans, student loans, and credit cards in Q1 2024.

So, what’s the best way to manage and chip away at your debt? There are two general strategies for paying down debt: the snowball method and the avalanche method. Read on to learn how they got their names and which may be the best option for you.

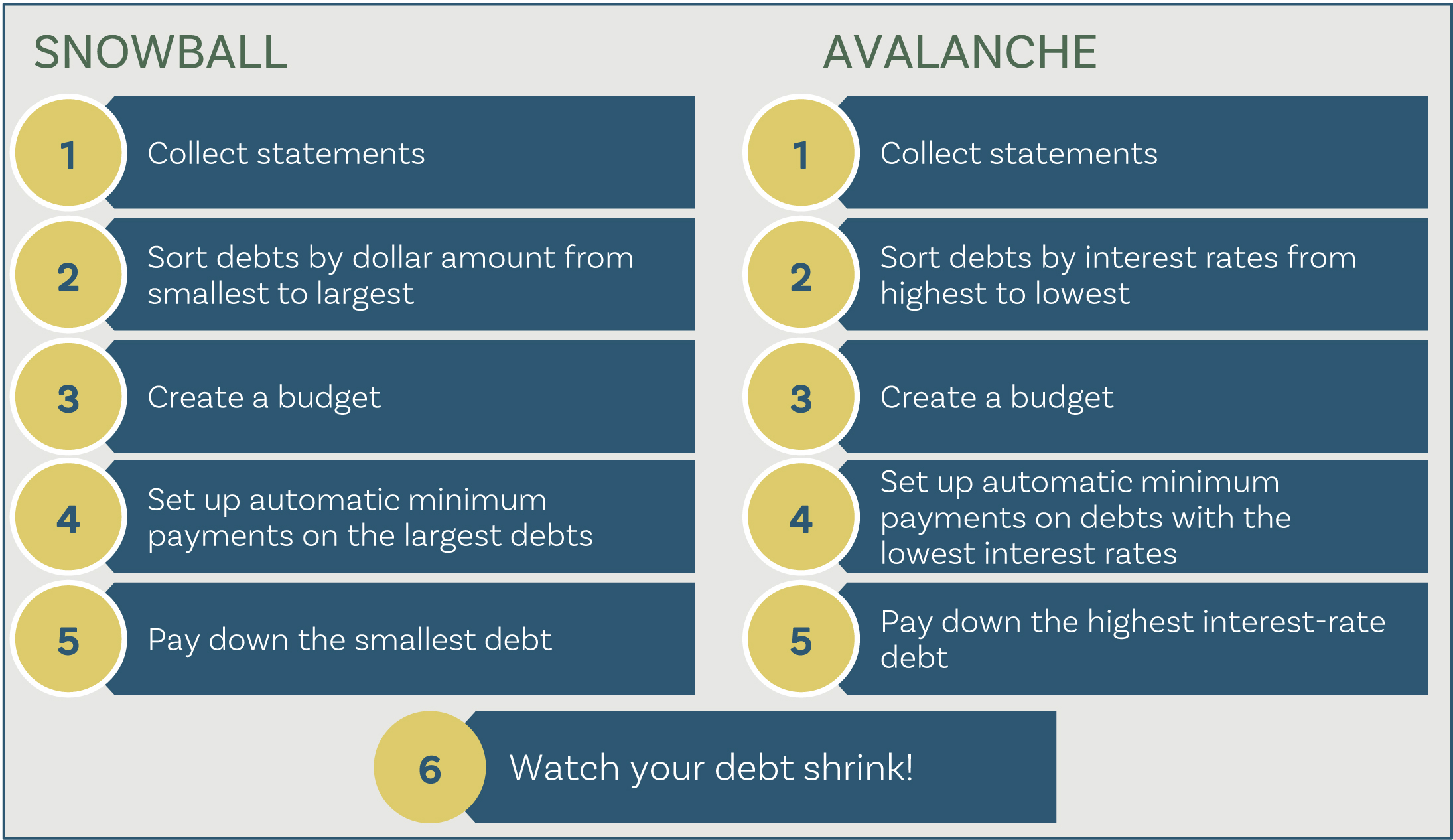

Snowball vs. Avalanche Debt Payment Strategy

As the name implies, the snowball method involves paying off your debts starting with the smallest total balance. You pay the minimum payment on all other debts and allocate as much as possible toward the smallest total balance. Once paid off, you move to the next lowest total, and so on, thus snowballing payments together to make larger payments.

The snowball method is useful for those with multiple outstanding debts. Targeting the lowest total balance first helps to lower the number of outstanding debts and build confidence in decreasing your debts—however, it may not be the debts with the highest interest rates.

The avalanche method targets the highest interest-rate debt. With this approach, you make the minimum payments to all other debts and put extra towards the highest interest rate. This creates an “avalanche” where your highest interest debts fall off first.

Using the avalanche method can reduce the overall interest paid on your debt. Anything more than the minimum payment is used towards paying the principal amount and saves you money in the long run. Some of these debts may have higher principals and take longer to pay off than the smaller amounts you’d pay off using the snowball method.

How to Start Paying Off Debt

First, determine whether the snowball or avalanche strategy will work best for you. Then, follow the steps below:

Get Guidance on Your Debt & Budgeting

As financial advisors, we benchmark the interest rates of debt to the potential return on investments. If the potential higher return in the markets is greater than your interest rate, you will grow your net worth by investing rather than paying off debts.

Do you feel a bit overwhelmed when looking at your debt? You don’t have to tackle it alone! Speak with a Carlson Investments advisor today to learn how we can offer personalized advice based on your situation and goals.

Carlson Investments does not provide tax, legal, or accounting advice. This content has been written for informational purposes only. Always consult your individual tax, legal, or financial professionals for advice tailored to your situation.

Let's Talk

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.

Contact Us