As an investor, you must understand how long you should stay in the stock market based on your long-term goals. Unfortunately, many make the mistake of focusing on short-term rewards, jumping in and out of the market quickly based on the performance of near term events.

Time in the market refers to your investment holding period for assets like stocks, mutual funds, and exchange-traded funds (ETFs). This could be days, weeks, months, years, or any time in between.

So, how long should you hold your assets? Let’s take a closer look at best practices.

Know Your Time Horizon

First, you need to determine your time or investment horizon. It sounds sophisticated, but this simply refers to how long until you’ll need your invested money. Along with your risk tolerance, your time horizon is a key factor in your portfolio’s asset allocation and diversification (more on this in a bit).

For example, investing for retirement is generally long-term. Meanwhile, college investing for a young child is medium-term, and anything under three years is short-term.

When you have a longer time horizon, you’ll typically want more exposure to stocks as they are expected to have higher returns. Your longer timeframe means you can wait out the market’s ups and downs, potentially reaping more benefits. Of course, you might make occasional adjustments in your portfolio based on the performance of your assets to rebalance your allocations and ensure you’re still on track toward your goals.

With a short time horizon, you might be safer investing in cash assets like savings and money market accounts or CDs. These don’t yield as high of a return, but they are low-risk.

Stay in the Market!

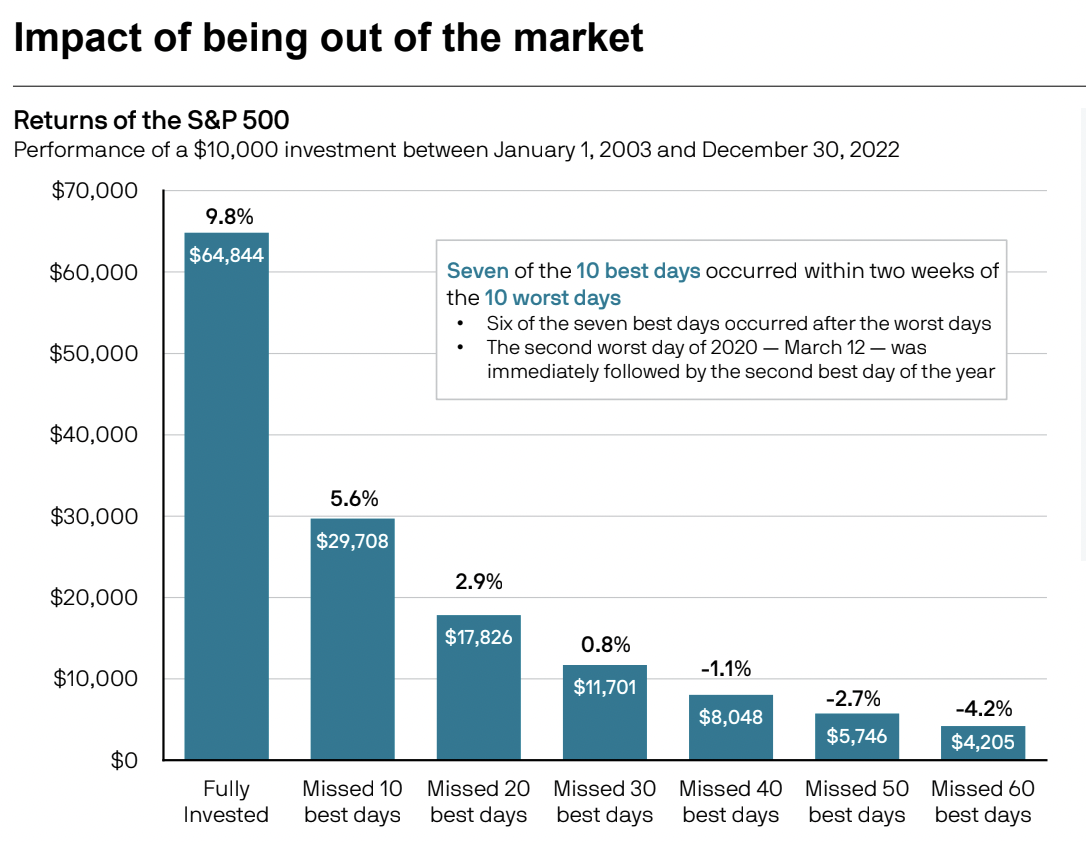

Once you’ve committed to stocks, stay in the market! The chart below illustrates how much worse your returns will be if you miss just 10 of the best days over a 20-year period.

So, why do people not stay in the market? In our experience, investors often sell stocks as an emotional response to headline news. But keep in mind that once an event becomes a headline, it’s most likely already priced into the markets.

In other words, don’t panic when the market dips. Selling after bad days may feel like you’re “getting out ahead,” but you’re more likely to miss out on the best market days—which often follow the worst! You could experience lower returns or even losses.

Develop a Sound Investment Strategy

You can protect your assets by establishing a sound strategy with your financial advisor and sticking to it. A diverse portfolio can improve your retirement outcome. There are two high-level steps to diversification:

- Asset Allocation: Dividing your investments among stocks, bonds, and cash and equivalents (the three main asset classes) based on your goals, timeframe, and risk tolerance

- Security Selection: Investing in different types of stocks, bonds, and cash (e.g., stocks from companies of various sizes, industries, and geographic regions)

And always remember Warren Buffet’s adage to “be fearful when others are greedy, and greedy when others are fearful.” In other words, be cautious about overpaying for an asset when its price skyrockets, as you could risk poor returns. However, investing in assets when others are fearful could lead to higher returns.

When investors sell their stocks out of fear, it can lead to a drop in prices. These assets selling for less than their intrinsic value (i.e., what they are objectively worth) are the ones Buffet advises looking out for. These are general guidelines, but important to understand. It’s where the phrase “contrarian investing” comes from.

Monitoring and understanding the markets is easier said than done—but it’s much easier when you work with a professional advisor! If you’re looking for someone to guide you on your time in the market, help you develop an investment strategy based on your needs, and provide overall peace of mind, chat with a Carlson advisor today.

Let's Talk

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.

Contact Us