“How are you compensated?”

If you’re in the market for a new registered investment advisor (RIA), this is one of the most important questions you can ask prospects. An RIA is a firm that guides you on securities investments and possibly manages your portfolio.

Berkshire Hathaway’s vice chairman and Warren Buffett’s business partner, Charlie Munger, once said, “Show me the incentive and I’ll show you the outcome.” You want your RIA to be motivated while ensuring they have your best interests front of mind.

Let’s take a closer look at the different types of business models and compensation structures you should keep an eye out for.

RIA Compensation Structures

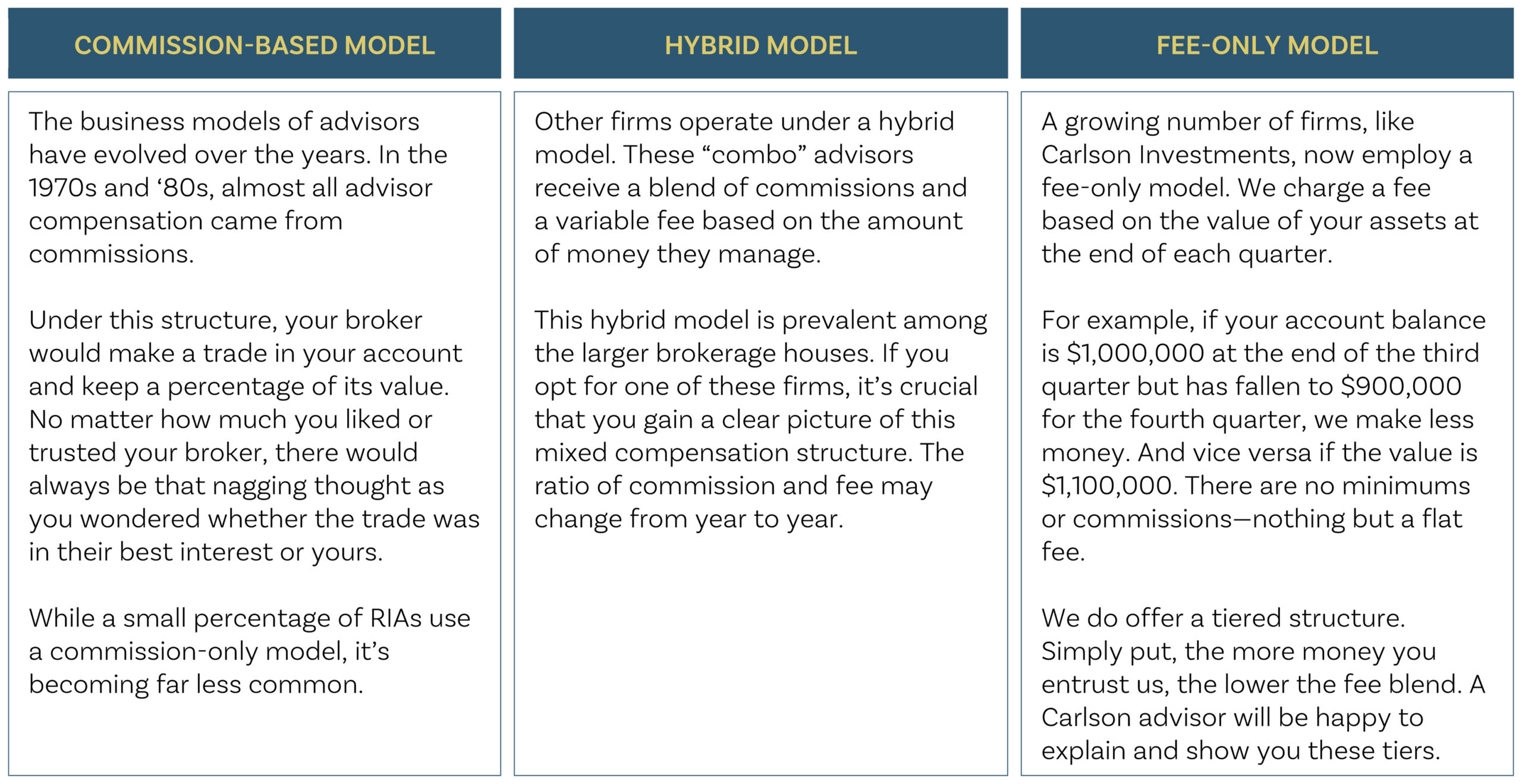

RIAs usually make money in one of three ways: commission-based, a hybrid of commissions and variable fees, or a fee-only model. Before choosing an investment firm, ensure you understand their fee structure and how it could impact your portfolio.

Understand Your RIA’s Compensation

Don’t be afraid to ask questions and research how each prospective RIA does business and compensates their advisors. You know how you get paid at your job. Shouldn’t you understand how your advisor gets paid for handling your money?

Are you searching for an RIA with a business model and transparent fee structure that aligns with your goals and focuses on building long-term relationships? Chat with a Carlson advisor today to learn more about our investment guidance and portfolio management services!

Let's Talk

Finding a better way doesn’t start with you learning about investment strategy. It starts with us learning about you.

Let’s get started.

Contact Us